Back in December 2021, Theta Lake partnered with Verint, forming a strategic relationship poised to tighten the customer engagement firm’s grasp on collaboration security and compliance solutions. Since then, I have heard about the firm at least once weekly.

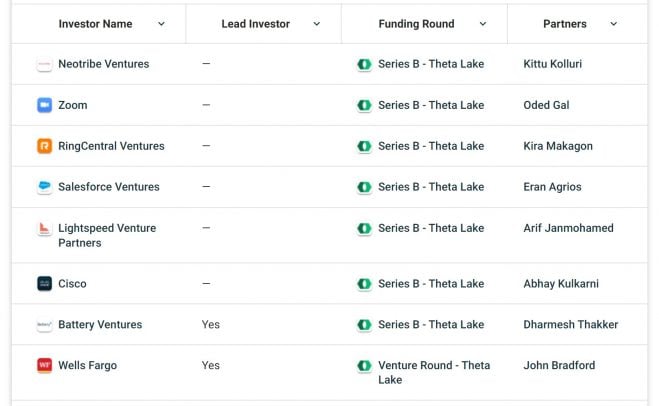

Recently, compliance and security startup; Theta Lake announced it had raised $50 million in a Series B funding round; led by Battery Ventures. Lightspeed Venture Partners, Neotribe Ventures; also joined the round.

Cisco Investments, RingCentral Ventures, Salesforce Ventures, and Zoom Video Communications Inc., UCC giants with deep investment-fund pockets, (also) participated in the Series B funding round. More on that later, but as you can imagine – they stand to gain a lot from the investment.

According to Theta Lake, the establishment, in total, has raised more than $70 million to date. The company says it plans to use the funds to expand its product offering, which today; spans video, voice, chat, documents, and email -while focusing on eliminating security risks involved in leveraging said technologies.

Securing Funds to Secure the Future of Work

In February, I met with Stacey English, Director of Market Intelligence at Theta Lake, to discuss 2022’s most pressing enterprise security challenges. In that interview, English, who is ironically enough – English – told me that chat content presents the most sizable threat to privacy and security for enterprises in 2022.

With its newly-acquired funding, Theta Lake wants to build out its tech stack; so organizations can further reduce the risk of unwanted intrusion. Devin Redmond, Chief Executive Officer/Co-Founder of Theta Lake: anticipates as much. As it stands, Theta Lake’s technology relies on ‘machine’ and deep learning, along with natural language processing, to capture, archive, detect, and surface any potential threats of attack.

It does all this across multiple channels, including chat, video, visual, voice, document, and email content. The company essentially does most of the heavy lifting, so companies do not have to, while the technology works to ensure that firms stay compliant while online.

More importantly, it can work to ensure that sensitive data stay out of the hands of bad actors. Its robust platform (already) extends certified integrations with Webex by Cisco, Microsoft 365 and Teams, RingCentral, Salesforce, Symphony, Verint, Vidyard, and Zoom. This is where the companies that invested in Theta Lake – well – their self-serving interests come into play.

With Chat, Theta Lake notes there are countless gaps in the compliance process. The way it fills those gaps, so to speak, is with full integration, native viewing, and supervision for chat channels that can send alerts and even prompt users to take action when needed.

All this is merely the tip of the iceberg (when it comes to) Theta Lake’s capabilities, (which also) include video. The company tackles video by removing key compliance blockers. It then assists risk managers/compliance teams in integrating video into their communication stacks.

Finally, for voice, arguably still one of the most popular (points of) customer contact – Theta Lake extends its purpose-built compliance suite that streamlines reviewing call recordings. According to Theta Lake, they make that process easier, faster, and more accurate thanks to the power of deep learning and compliance that leverages artificial intelligence.

It leads to another valuable aspect of these technologies; it may extend more opportunities for automation. Users can automate various compliance components like policy risk detection and even manage their workflows for potential regulatory or compliance hazards.

Mitigating Risk of Intrusion to Delight Customers

The risk of intrusion becomes more imminent as more companies adopt enterprise-grade collaboration technology. Theta Lake hopes that with the newly-secured funds, they can build out even more robust systems to support integrations it facilitates with RingCentral, Avaya Cloud Office, Symphony: along with other providers.

Today, Theta Lake reports: it now has more than 50 customers, 75% of which come from the highly-regulated world of financial services. The company also dabbles in the government, healthcare, tech, and manufacturing sectors with the folks in these industries needing all the help they can get in the compliance department.

Digital comms channels have created kind of a double-edged sword. On ‘one hand,’ these channels led to a word-class way for customers and brands to interact.

Workplace collaboration tools: have also done a great deal to ensure that internal terms stay connected and that all communications – no matter where an employee resides, are facilitated. The other half of that is the (fairly obvious) security challenges such as freedom and flexibility in workplace comms might present to users.

So far, Theta Lake is helping customers: Wells Fargo, TD Securities, Advisor Group, Longview Partners, Attivo Group, Reeves Independent, and Tupicoffs, companies that require robust security measures to be put in place to protect assets like proprietary data.

In a recent interview with VentureBeat, Redmond said the company hopes to triple its customer count and revenue over the next 12 to 18 months.

Is an Acquisition in Order?

While there is no concrete answer to this question, most signs seem to point to a potential future acquisition. As a young firm, the company has already forged quite a few meaningful partnerships with some key industry players. Leveraging APIs, Theta Lake amassed a network of powerful integrations, the kind of integrations deemed beneficial to anyone who decides to leverage the technology.

Another central part of Theta Lake’s strategy is the willingness and ability to work with the platform designers to beef up their compliance/security measures.

Any company interested in gaining that kind of value with purchase – might do well following the buyout of Theta Lake, but an acquisition could take years. It might take several more years simply for the firm to prove itself, although I would argue that the startup is quite ripe for the picking.

As for further speculation, if there is no acquisition, we can almost certainly count on Theta Lake undergoing countless more funding rounds.

If there is any indicator of Theta Lake’s success, it has to be the uptick in usage it continues to experience: along with the countless accolades it earned in recent times. With multiple UC awards for the best tech startup and the best UC compliance tool and its multitude of patents – well, this all speaks volumes about what might be in store for the budding startup.